PR Newswire - Four in Five iGaming Operators Faced Increased Fraud in the Past Year - Sumsub Global Report

|

- 83% of iGaming operators have experienced fraud in the past year

- Latin America saw the steepest fraud rise (32% increase), while Africa recorded the biggest drop

- Deposit stage is now the most targeted part of the user journey

- Growth in AI-generated fake documents encountered by 78% of operators

- Recently released tools like Non-Doc verification and Sumsub ID helped improve conversion by cutting onboarding time and boosting pass rates

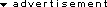

LONDON, June 24, 2025 /PRNewswire/ -- Sumsub, a global leader in verification, today released its 'State of Identity Verification in the iGaming Industry 2025' report, offering a comprehensive look at how fraud threats are shifting across regions, stages, and attack types. The latest data—drawn from Sumsub's internal data and a new industry survey—highlights an alarming rise in AI-generated document fraud, a spike in attacks at the deposit stage, and growing regulatory pressures on operators worldwide.

Fraud attacks continue to increase and impact iGaming firms

According to Sumsub's survey, 82.9% of operators have experienced an increase in fraud over the past year, with many struggling to keep up. One of the most notable shifts is when fraud is happening. According to findings, most fraudulent activity occurs between 4-8 a.m., while legitimate players typically register around 6 p.m. Attacks now peak at dawn, a time when most compliance teams are offline—reaffirming the growing importance of 24/7, automated anti-fraud systems.

Regionally, Latin America recorded the steepest rise in fraud rates—from 0.88% in 2024 to 1.16% in 2025, a 31.8% increase.

Region | Fraud rate- 2024 | Fraud rate - 2025 | Change |

Africa | 2.99 % | 2.55 % | 14.7% decrease |

Asia | 3.49 % | 3.28 % | 6.0% decrease |

Europe | 1.18 % | 1.24 % | 5.1% increase |

LATAM | 0.88 % | 1.16 % | 31.8% increase |

MENA | 2.01 % | 2.10 % | 4.5% increase |

North America | 1.16 % | 1.22 % | 5.2% increase |

Fraud is not just concentrated during the sign-up stage

According to Sumsub's report, the deposit stage is now the most targeted point in the user journey, with 41.9% of operators citing it as the primary fraud flashpoint. Onboarding/registration (23.8%), withdrawals (22.9%), and in-game activity (11.4%) also remain vulnerable.

When asked about dangerous fraud schemes currently facing the industry, operators cited identity fraud (64.8%), money laundering (64.8%), and bonus abuse (63.8%) as the top three threats. Payments fraud (31.4%) and account takeovers (23.8%) followed behind.

AI-powered fraud continues to accelerate

A staggering 78% of respondents said they had encountered a growth in AI-generated fake documents in the past year—an indication that these once-novel tactics are becoming mainstream in fraud arsenals. But the threat doesn't stop at documents. The use of generative AI in fraud continues to include deepfakes, as criminals form organized attack networks that exploit platform vulnerabilities.

Separate from the report, new *Q1 Sumsub data—across all industries—revealed a staggering 700%% global increase in deepfake fraud between Q1 2024 and Q1 2025, with synthetic identity document fraud rising 195%.

When asked about changes in AI-powered fraud over the past year, 43.8% of iGaming operators reported a noticeable increase, while 34.3% saw a large spike. Deepfake fraud continued to surge in 2024, with particularly alarming rates in Brazil—where deepfakes now occur at five times the rate seen in the U.S. and ten times the rate in Germany, in Q1 2025. This spike coincides with Brazil's regulatory transition, highlighting how fraud attempts intensify when operators first roll out compliance requirements.

Verification speed becomes a competitive advantage

As fraud gets more sophisticated, verification speed has become a key growth lever. Average verification time across the industry has decreased from 32 seconds in 2023 to just 25 seconds in 2025. This speed translates into improved conversion and retention. Recently released solutions like Non-Doc Verification (a method that enables users to verify identity without uploading documents), Reusable KYC (which allows returning users to skip repeat verifications), and Sumsub ID (a portable digital identity that users can reuse across platforms) are helping to streamline onboarding.

Operators using Non-Doc reported a 53% drop in processing time and 35% more clients onboarded successfully. Meanwhile, Reusable KYC solutions have helped slash return-user verification time in half, and Sumsub ID boosted pass rates by 30%.

"iGaming operators are facing pressure from both sides—more sophisticated fraud on one hand, and rising compliance demands on the other," said Kris Galloway, Head of iGaming Product at Sumsub. "The key to winning on both fronts is speed and flexibility and, needless to say, a robust fraud prevention system. New solutions like Non-Doc verification, Reusable KYC, and Sumsub ID are giving operators a serious edge—not just in stopping fraud, but in onboarding legitimate users faster. But tech alone isn't enough. You need a multi-layered, end-to-end approach that protects the entire player journey, from registration through withdrawal."

Compliance is tightening across jurisdictions

Beyond fraud, compliance remains a major pain point. Nearly a third (29.5%) of operators say keeping up with new regulations is "very challenging," especially as jurisdictions continue to introduce stricter requirements around AML, age verification, and data handling.

From Europe to Latin America and Southeast Asia, iGaming operators are navigating increasingly complex regulatory frameworks. Brazil, for example, transitioned from a 'grey market' to a regulated one in January 2025, mandating biometric onboarding, ISO 27001-level security certifications, and stiff penalties for non-compliance reaching up to R$ 2 billion.

Meanwhile, Europe is at the forefront of regulatory innovation, with the UK introducing affordability checks and ad restrictions, and Sweden and Denmark enforcing supplier licensing. In Asia, countries like the Philippines and Thailand are actively refining their regulatory architecture, from cybersecurity mandates to capital requirements for integrated resorts. These shifts demand sophisticated, adaptable verification systems capable of keeping pace with evolving local standards.

To download the report for free, please visit: https://sumsub.com/igaming-report-2025/

Methodology

The content of the report is based on detailed statistics and analysis of current fraud incidents (all internal data was aggregated and anonymized). iGaming and identity fraud experts from Sumsub and company partners also share their predictions for the industry, highlighting complex challenges related to different fraud schemes and practical measures needed to prevent them and protect businesses.

*Additional data, Based on Sumsub's internal statistics, drawn from millions of identity verification checks conducted globally between Q1 2024 and Q1 2025.

About Sumsub

Sumsub is a full-cycle verification platform that secures the whole user journey. With Sumsub's customizable KYC, KYB, Transaction Monitoring, and Fraud Prevention solutions, you can orchestrate your verification process, welcome more customers worldwide, meet compliance requirements, reduce costs, and protect your business.

Sumsub has over 4,000 clients across the fintech, crypto, transportation, trading, e-commerce, education, and gaming industries, including Bitpanda, Wirex, Avis, Bybit, Vodafone, Duolingo, Kaizen Gaming, and TransferGo.

Sumsub has citations in research published by global institutions such as the United Nations and Statista, as well as ongoing consultancy and engagements with INTERPOL.

ภาษาไทย

ภาษาไทย English

English